Current Market Trends

We look at Current Trends which are underpinned by compelling Market Fundamentals. This empowers our Clients to select High Yield Investment Opportunities that reflect today's Market.

Assisted Living

Assisted living accommodation has been commissioned by local authorities and health authorities in the UK since the late 1980s as a result of the drive to accelerate the closure of the long-stay inpatient hospitals for people with a learning disability and autism.

This type of accommodation refers to housing that is specifically designed to meet the needs of elderly and disabled residents, as well as those living with enduring illnesses, offering a range of support services and amenities to help them live independently.

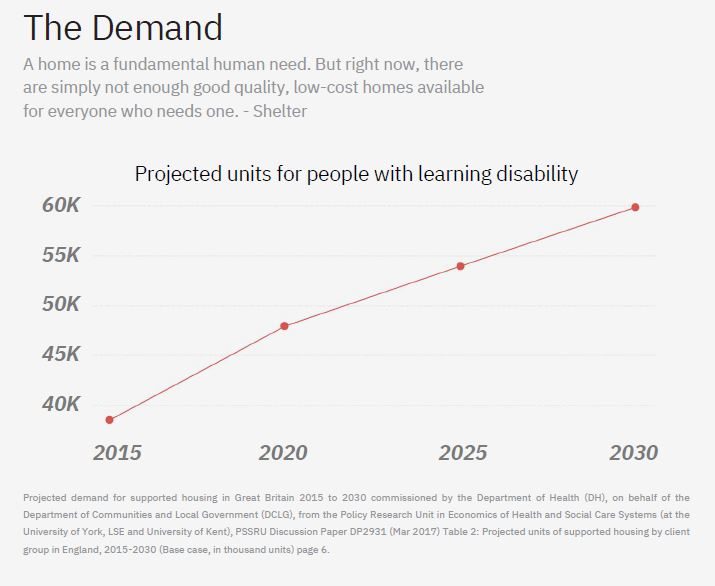

It is estimated that around 1.2 million people in the UK are in need of some form of care and support due to aging, disability, or illness. This number is expected to increase as the population ages and life expectancy continues to rise.

Due to incredibly strong Market Fundamentals, Assisted living continues to outperform traditional property investments. Find out how to make consistent returns from this little known Property Sector .

Why Invest in Assisted Living?

Strong Yield

Assisted Living has historically delivered consistently high returns and ranks highly among our client base

Government Backed Returns

Rental income is paid direct by DWP (Department of work and pensions) which means payments are reliable and always on time. Contracts are agreed on 25 year terms, demonstrating Government commitment.

Inflation Hedge

Contract are agreed at 1% + CPI (Consumer price index) year on year. This means your returns are continuously hedged against inflation

No Void Periods

Returns paid direct by the UK Government means there are zero void periods

Discover a new way of investing

Assisted Living Opportunities come with Short term, Medium and Long term investment options.

Investors can generate stable, secure returns in investment vehicles which both perform well and create substantial social impact.

Get in touch below and one of our consultants will be in contact to explore ways of expanding your Portfolio.

Get in touch

Telephone: 0207 770 6551

E-mail: enquire@westportcapital.uk

Address: 10 Lower Thames Street, City of London, EC3R 6EN